PayPal was established in December 1998 as Fieldlink, later renamed to Confinity to develop security software for handheld devices. However, it wasn't until it pivoted to a digital wallet platform in 1999 that PayPal started on the path to becoming the online payments behemoth we know today.

In March 2000, Confinity merged with X.com, an online banking company founded by Elon Musk. X.com was later renamed PayPal in 2001 and went public in 2002. It was quickly acquired by eBay later that year for $1.5 billion, becoming the payment method of choice for eBay users. Elon Musk later recycled the X.com domain to use it again after he acquired Twitter.

PayPal was spun off as an independent company in 2015 and has since grown through various acquisitions, expanding its services globally. Today, PayPal operates a worldwide online payments system that supports online money transfers and serves as an electronic alternative to traditional paper methods like checks and money orders. It has over 400m active customers and operates in 200 markets worldwide and is used by over 30m merchants.

What is PayPal?

PayPal is fundamentally a payments solution. What is started it's main focus was on facilitating payments for online e-commerce purchases.

It has a number of advantages over its rival Stripe. Apart from having over 20 years experience in global payments, you only need to give your credit card details once and you can use your PayPal account to complete the purchase. This appeals to a lot of users, particularly in the B2C market space.

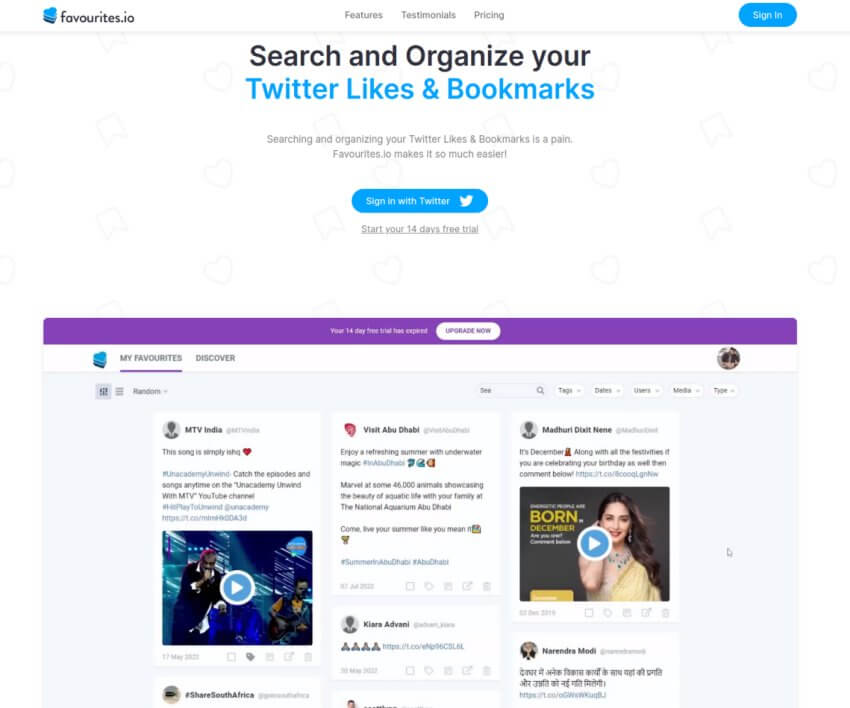

One example of that was Favourites.io which provides a SaaS solution to help organize and search Twitter bookmarks and likes. It's very popular with high end influencers, marketing people, researchers and journalists. Initially they used Stripe for payments but many preferred to use PayPal as many of the people involved work as independent contractors and wanted more control over their purchases.

The Problem with PayPal Metrics

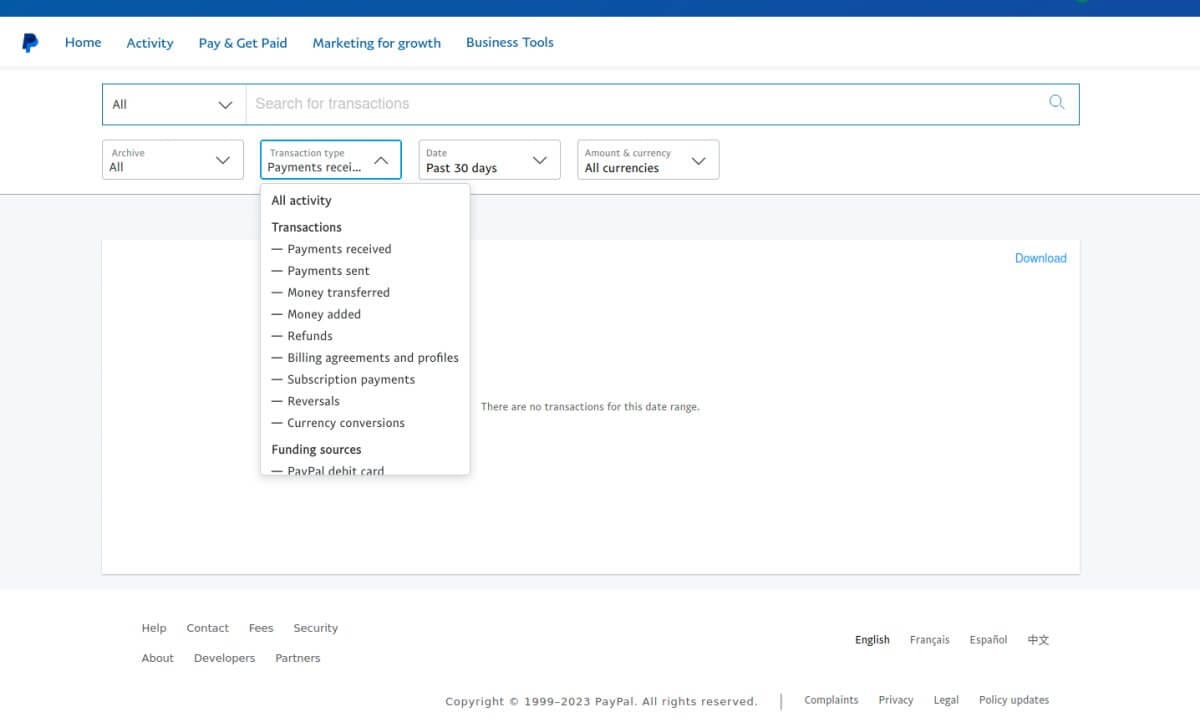

While PayPal facilitates smooth online transactions, its analytical capabilities fall short for SaaS businesses. The platform provides elementary financial and transactional data. There is no attempt to analyze the transaction data or to provide any SaaS metrics for subscription based companies. Typical information that is available includes:

- The Monthly Financial Summary presents a detailed record of all transactions within a month, including customer payments, PayPal fees, business expenditures, bank movements, etc.

- The Transaction Details Report delivers specifics on account activities and updates on product shipping statuses.

- Sales Insights render a broad graphical overview of your company's sales trends, monitoring your sales numbers, transaction volumes, and average prices over a period.

- Case Reports, formerly known as Downloadable Dispute Reports, outline the current standing of any disputes or chargebacks filed against your account.

- Recurring Payments Profile Reports are available for those using the Recurring Payments Feature, providing insights into ongoing subscription payments.

However, PayPal does not offer insights into vital customer data such as:

- The specific products customers engage with

- The duration of their patronage

- Their subscription model

- The conditions of these subscriptions, among other details.

To be fair to PayPal, this is fine. PayPal is a great payments solution aimed at retail transactions and its main concern is money in and money out, it is not really designed for SaaS Metrics but for expanding SaaS enterprise, it's crucial to have access to these metrics to monitor and drive growth effectively.

Therefore, it is up to the user to apply business intelligence on top of this raw data. PayPal does allow you to export your transactions and you can of course import the data into a spreadsheet and calculate the metrics by hand. Not easy, and time consuming but at least it can be done.

PayPal SaaS Metrics Done Right

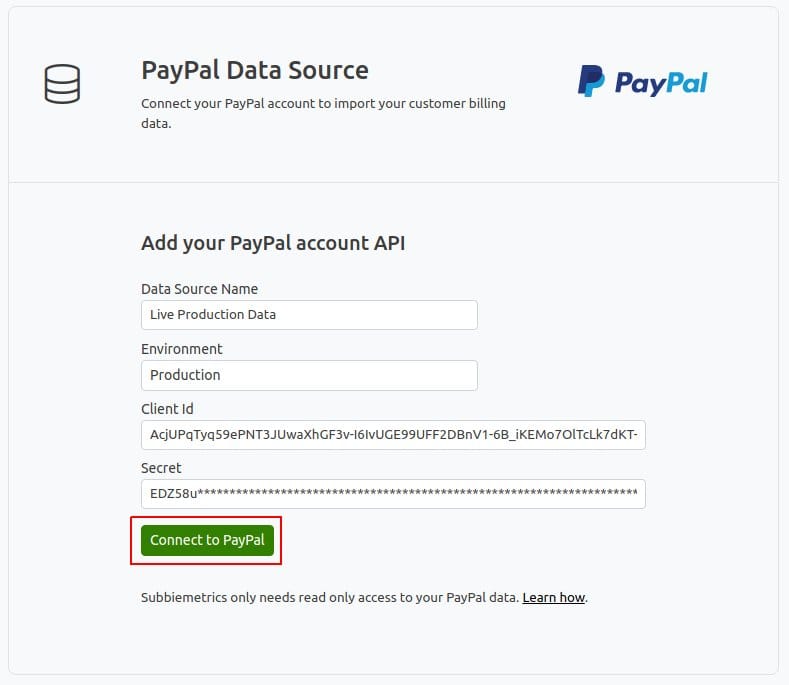

Subbie offers a way to do this right. Simply connect your PayPal account to start importing your transactions and your data will sync automatically from then on. Check out this helpful guide on connecting PayPal to Subbie to get started. To connect your PayPal account you will need to get a set of PayPal API credentials. then create a datasource in Subbie and enter the details and click on Connect to PayPal. The initial sync takes some time but once its done your SaaS metrics will be available and your data will be synced daily after that.

SaaS Metrics for PayPal

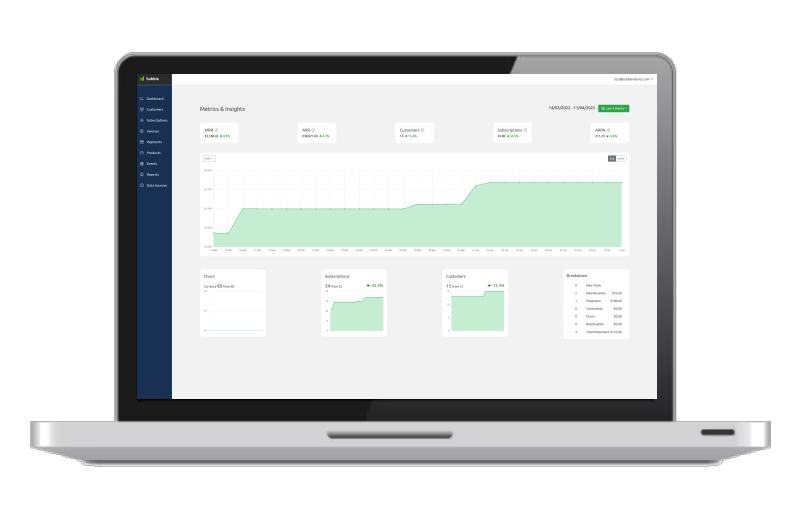

Once you have connected Subbie to your PayPal account you can get the following metrics:

- Monthly Recurring Revenue (MRR)

- Expansion Revenue

- Revenue Contraction

- Revenue Churn

- New Revenue

- Reactivation Revenue

- Net New Revenue

- Annual Run Rate (ARR)

- Trials

- Customers

- Customer Churn

- Average Revenue Per Account (ARPA)

- Tax Summary

- Revenue by Country

- Sales by Plan

- Sales by Product

Getting SaaS Metrics for PayPal could not be simpler. The great thing about using Subbie is that you can get your data from multiple data sources and blend it all together to give you a holistic view your your business. So if you are using other payment providers such as Stripe you can combine it with your PayPal data on one dashboard.

You can try Subbie for free for 14 days. Start your free trial today, or talk to a member of our team if you have any questions!